What’s New at GPW

It’s now officially fall, and it seems like our weather may finally be taking the hint. Many of usare prompted to begin thinking of family gatherings, year-end plans, and goals for the coming year when the weather eventually shifts. We certainly have been doing so here at Gentry. Keep following our newsletters over the next few months as we look forward to sharing some exciting news about Gentry’s plans and how we will be even better equipped to provide the concierge wealth management that we promise.

This month’s issue of The Advisor explores the economy and year-end estate, tax, and gifting strategies that can help you achieve your financial goals.

Are We in a Recession?

It’s the question on everyone’s mind right now: “Are we in a recession?” When conducting economic analysis, we prefer to have quantitative research supported by detailed definitions and calculations. Unfortunately, the definition of a recession is not as quantitative as we would hope. The National Bureau of Economic Research (NBER) defines a recession as “a significant decline in economic activity that is spread across the economy and lasts more than a few months.” There are many factors that can lead to a decline in economic activity, including consumer spending, corporate profits, real household income, unemployment rates, and industrial production. Two of these stand out to us currently: corporate profits and unemployment rates. During the second quarter, real GDP decreased by 0.60%, thus meeting expectations. At the same time, corporate profits continued to expand and rose by 4.6%. This leads us to believe that corporate profits have yet to see the “significant decline in economic activity” that the NBER is looking for in a recession. Additionally, the unemployment rate continues to remain historically low at around 3.8%. Even though these two factors are comparatively better than others assessed, we are reminded that the market is historically a leading indicator of a recession.

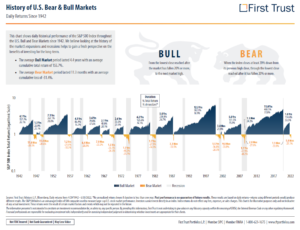

Table 1: History of U.S. Bear & Bull Markets

Since 1942, we have seen 14 bear markets and 13 recessions. Eight of these recessions have either coincided with, or occurred shortly after, a bear market (Table 1). According to the Corporate Finance Institute, the market will continue to fall after entering a bear market for an average of five months. Decreasing investor confidence, high inflation, and high interest rates are three factors that aid in both a bear market and a recession. We’ve witnessed this in the final week of September with continued market volatility as well as a bear market for the Dow Jones. Additionally, this year both inflation and interest rates have continued to rise as the Fed attempts to manage inflation and reduce the severity of a recession.

As we enter Q4, we continue to focus on reducing risk and volatility in our portfolios by taking advantage of structured products, value-oriented equities, and market diversification. You can be assured that we are aware of your concerns about the market and economic pressures and are taking measures to address these concerns. We are making tactical shifts in your portfolio and are determined to provide you confidence in your financial future. We continue to ask ourselves questions such as “Does their financial plan match their risk tolerance? How will their plan be impacted by continued market volatility or a recession? What other investment options can we use to further provide confidence to them?” Each market and portfolio review our team completes allows us to answer these questions with confidence knowing that our first priority is you. We know the media “noise” can be overwhelming, so please don’t hesitate to reach out to us to discuss your portfolio and financial plan to better understand how current events may or may not impact your financial future.

GoalVest Portfolio Update

The S&P 500 is down another 4% approximately over the last week (as of 9/27/2022).Additionally, the Fed continues to face pressure from inflation as this month’s report came in at 8.3%, well above the 2% target. The Fed increased the federal funds rate by 0.75% last week to help achieve this target and expects the rate to peak closer to 4.6% in 2023. Despite these statistics, unemployment rates remain close to historic lows and consumer spending remains solid. And while we continue to expect more near-term volatility due to inflation, interest rates, and economic uncertainty, we have already seen a decent moderation in US stock valuations. The S&P 500 is now trading below its 5-yearaverage price-to-earnings ratio and is aligned with its long-term average. This suggests that a significant portion of bad news is already priced into valuations.

On the international front, energy prices fell amid a continued economic deterioration in Europe as Russia continues to lose momentum in Ukraine. This news, among other things, causes us to remain firmly underweight international stocks and bonds and overweight high-quality defensives.

We also continue to maintain balanced portfolios that hold quality US investments and defensive, hedged positions to help weather volatility. This positioning allows us to stay invested for the long term because, as history has shown, attempting to time the market typically results in realized losses and missed gains.

Sevasti Balafas, CFA, CPWA®

CEO & Founder

GoalVest Advisory

Required Minimum Distributions & Annual Gifting

Where has this year gone? It seems like just last month we were wishing you a relaxing summer and safe travels. Now the leaves are changing and we are preparing for the holidays. With this in mind, October is an opportune time to prepare for year-end financial and estate planning decisions. Please take a few moments to read through this full article, as some of these deadlines may apply to you.

Required Minimum Distributions (RMDs)– For Ages 72+As you may know, the IRS requires that you take an annual distribution from your traditional Individual Retirement Accounts (IRAs) starting the year you turn 72 (or the year you turned 70½ for anyone born before 7/1/1949). We can gladly assist with this calculation of your Required Minimum Distribution (RMD) amount upon your request.

Qualified Charitable Distributions (QCDs) – For Ages 70½+

While you may use your RMD for income, holiday gifts, special projects, etc., it is possible that you don’t need these funds. If this is the case, you may consider reinvesting the after-tax proceeds of your RMD or giving this money to charity. Gifting these funds directly to a charity is considered a Qualified Charitable Distribution and allows you to take advantage of special tax savings. Don’t hesitate to contact us and your accountant if this is something you are interested in doing.

Retirement Contributions and Roth Conversions

Don’t forget to evaluate your retirement accounts and consider if you would like to contribute to your accounts this tax year, or possibly even utilize a Roth Conversion.

Annual Gifting

Lastly, annual gifting for estate and tax planning purposes is another item that typically arises this time of year. For 2022, you can gift up to $16,000 per person ($30,000 if married and filing taxes jointly) and not dip into your estate tax lifetime exemption. Next time you are thinking of gifting to charity or family members, consider taking advantage of this rule or even donating appreciating securities.

As always, we look forward to coordinating with you, your attorney, and your accountant to help accomplish your charitable, tax, and estate planning goals for this year. If you have any questions over these end-of-year planning strategies, please don’t hesitate to give our office a call.